Founded in 2002 as Poland’s first leveraged foreign exchange brokerage house, X-Trade morphed into X-Trade Brokers in 2004 to comply with new Polish regulations. It then rebranded to its current incarnation, XTB Online Trading (XTB), in 2009 and went public, listing on the Warsaw Stock Exchange in 2016 under the ticker symbol XTB.

XTB has been steadily making inroads into the highly competitive and ever-changing online brokerage landscape and currently provides access to a variety of markets such as forex, shares, indices, metals, commodities and even cryptocurrencies. The company is regulated in the U.K. and registered with the Financial Conduct Authority (FCA #522157) as well as the Polish Financial Supervision Authority (KNF). Like many forex brokers, XTB does not accept U.S. traders.

To register XTB broker, click here XTB.Com

XTB’s flagship platform is a web-based offering named “xStation 5.” This, coupled with the ubiquitous MT4 (downloadable) platform and a functional mobile application, comprises XTB’s entire online offering to the consumer. While ancillary costs were on par with industry standards, XTB’s consistently lower spreads were hard to ignore as they clearly separated it from the competition. Investopedia’s ranking algorithm factored this in when recognizing XTB’s appeal to cost-conscious traders.

KEY TAKEAWAYS

- Rated our Best Forex Broker for Low Costs.

- XTB provides access to a variety of markets such as forex, shares, indices, metals, commodities, and even cryptocurrencies.

- XTB offers maximum leverage of up to 500:1 for non-U.K. accounts, while U.K. accounts get up to 30:1 leverage.

To register XTB broker, click here XTB.Com

Who XTB Online Trading (XTB) Is For

XTB is a solid choice for traders that want to minimize their costs, whether it be the inherent cost of placing a trade (bid/ask spread) or not having to be burdened with extraneous costs, such as wire fees. XTB offers maximum leverage of up to 500:1 for non-U.K. accounts while U.K. accounts get up to 30:1 leverage. The firm places an emphasis on customer support and offers relevant educational tools and research amenities that would be well-suited to a novice trader. This company is ranked as the winner of Investopedia’s Best Forex Broker for Low Costs.

Pros

- Lowest FX spreads

- Regulated by FCA (U.K.)

- Offers protection for client accounts

- Emphasis on customer service

Cons

- Does not accept U.S. clients

- Non-FX spread costs are high

- No guaranteed stop loss

- No back-testing or automated trading capabilities

Pros Explained

- XTB advertises minimum FX spreads of 0.5, and no commission, for “Standard” accounts, and 0.1, with commission, for “Pro” accounts. This is, by far, the best in the retail FX brokerage space.

- XTB Online Trading (XTB) is regulated by the Financial Conduct Authority (FCA #522157) which is one of the main regulatory agencies in the U.K. and is highly regarded globally for being strict in ensuring that market practices are fair for both individuals and businesses. Simply put, being regulated by a reputable government-backed agency goes a long way towards establishing the credibility of a firm. Traders accept the risk that is inherent in markets but they would like the peace of mind knowing that their funds are not subject to risks outside of the ones that they are taking, such as counter-party risk.

- XTB offers “negative balance protection” which has become a fairly important feature that most online brokers are offering these days. The catalyst was most likely the SNB event of January 15, 2015 that roiled the markets, especially the highly leveraged retail FX market.

- XTB places an emphasis on customer service which includes 24/5 telephone support with a dedicated account manager and live chat facility. Being able to readily contact a broker is crucial for anyone engaged in the arena of online trading.

To register XTB broker, click here XTB.Com

Cons Explained

- XTB does not accept U.S. clients due to regulatory constraints, which precludes it from truly being considered a global broker. This would be a red flag were it not for the fact that the company is regulated by the FCA which, along with U.S. regulatory agencies (NFA, CFTC), is widely considered to be the preeminent regulatory body.

- XTB charges commissions for both cryptocurrency (Pro) and stock CFD (Standard and Pro) transactions, and these are not as advantageous to the client.

- XTB does not offer guaranteed stop losses (GSLO) making it one of the few prominent forex brokers not to do so. GSLOs protect the trader from market gap risk and many brokers are willing to offer it (for an additional charge) and accept the risk themselves.

- XTB’s xStation 5 is not equipped with back-testing or automated trading capabilities, leaving MT4 as the only alternative for algorithmic traders.

To register XTB broker, click here XTB.Com

Costs

The totality of XTB’s fee and cost structure is competitive within the online forex brokerage arena. What sets XTB apart is its advertised minimum FX spreads for the different account structures. XTB’s “Standard” account quotes a minimum spread of 0.5, while its “Pro” account offers a minimum spread of 0.1. There is, however, a commission of $3.50/lot added for trades on Pro accounts. In retail FX parlance, it is generally understood that one standard lot is 100,000 units of the base currency, so this would translate to a minimum spread of 0.45, still among the best in the industry.

XTB states that “the average spread on EUR/USD for the last quarter was 0.43 (Pro accounts) and 1.02 (Standard accounts).” The 0.43 is the average spread before commission was added, so the actual average EUR/USD spread for Pro accounts would have been 0.78 which, again, is among the best in the online forex brokerage industry, if not the best. XTB charges commissions for cryptocurrency (Pro) and stock CFD (Standard and Pro) transactions, as well.

XTB does charge an inactivity fee of €10 if there is “no opening or closing of the position on the Customer’s account within the last 365 days and no cash deposit within the last 90 days.” There are also fees for client withdrawals of less than a specified amount from their cash account, a percentage charge for withdrawal to a credit card, and percentage charges for using e-commerce sites (Skrill, Neteller, SafetyPay). There are, however, no costs for incoming or outgoing wire transfers or for closing an account.

XTB does not have a minimum deposit requirement for customers wishing to open a live account, but logic dictates that this amount will be subject to the margin requirements of the smallest trade size that the customer wishes to place. International clients with high account balances are eligible for cashback rebates and welcome bonuses while high-volume-trading U.K. clients are offered lower spreads.

To register XTB broker, click here XTB.Com

Trade Experience

xStation 5, XTB’s custom trading application, is a streamlined trading platform that is stable and easy to access from any browser (Chrome, Firefox, Safari, or Internet Explorer). User interface is fairly standard with a simplicity that enhances its appeal. It isn’t the most feature-rich platform, but its ease of use somehow makes it appear more functional than it actually is.

This is the company’s flagship offering and provides an updated look and feel, one-click trading, and full integration across desktop and mobile platforms that should serve traders well. Entering trades, building watchlists and modifying charts all seem simple and intuitive. FAQs and educational resources can also be launched from within the trading application. Traders receive notifications directly on the platform or mobile application.

That being said, there were downsides. The ability to create custom indicators was not an option. Of course, XTB does offer the standard MetaTrader4 platform, which does have this and other features for traders already familiar with the third-party application.

xStation 5 has three basic order types with the option of attaching “take profit” and/or “stop loss” orders to them. Additionally, the trader can choose to make the regular stop loss a trailing stop loss prior to, or after, execution of a trade.

To register XTB broker, click here XTB.Com

- Market – The simplest order where a trader signals that their trade request should be executed at the prevailing market rate.

- Limit – A pending order where the entry is at a predetermined point below or above the prevailing market rate depending on whether it’s a buy or sell. The trader also has the option of selecting the expiration time of this order.

- Stop – A pending order where the entry is at a predetermined point above or below the prevailing market rate depending on whether it’s a buy or sell. The trader also has the option of selecting the expiration time of this order.

The mobile version of xStation 5 includes most of the functionality available in the desktop application, except the ability to set price alerts, which seemed like a peculiar oversight. Traders can access XTB’s trading instruments, complex order types, account details, and charting from the Android or iPhone apps. A streaming news feed is also available on the mobile application.

The mobile version of xStation 5 includes most of the functionality available in the desktop application, except the ability to set price alerts, which seemed like a peculiar oversight. Traders can access XTB’s trading instruments, complex order types, account details, and charting from the Android or iPhone apps. A streaming news feed is also available on the mobile application.

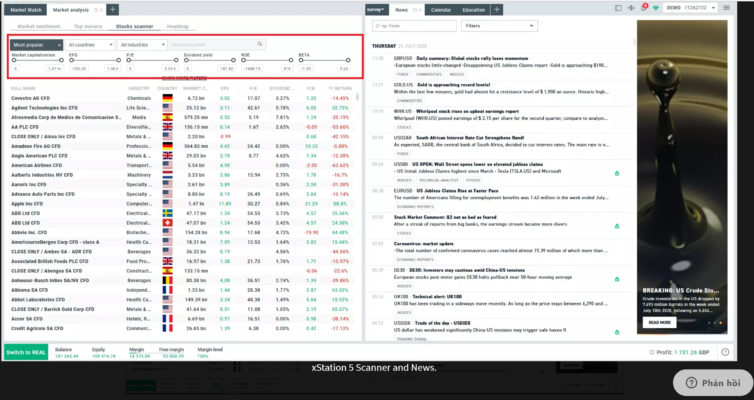

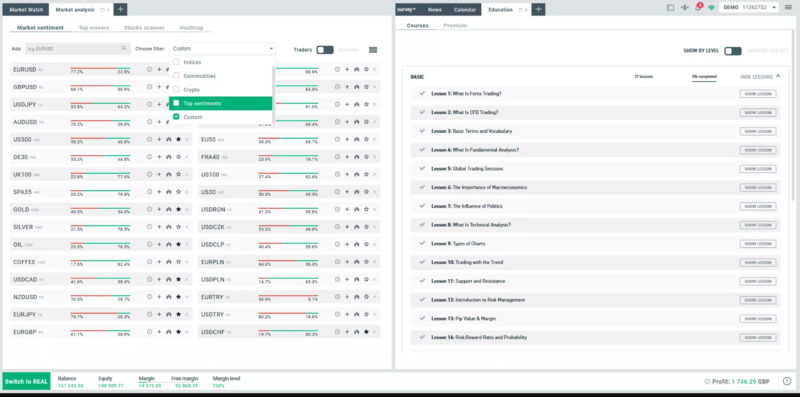

XTB does not offer social (or “copy”) trading, money manager accounts, or a free VPS service. However, there were a few unique offerings that may be worth a second look by some traders. The inclusion of “market sentiment,” “top movers,” “stock scanner,” and “heat map” tools is impressive.

To register XTB broker, click here XTB.Com

XTB does not offer ready-made products for back-testing, though clients can create their own back-testing applications as XTB offers an open API both for MT4 and xStation. XTB uses smart-order routing for equities and equity CFDs. However, XTB does not act as a direct member of any exchange as it executes all trades via a third-party broker.

To register XTB broker, click here XTB.Com

Range of Offerings

XTB provides access to a broad selection of financial instruments across a wide range of different asset classes. The product catalog includes:

- 48 currency pairs

- Over 20 global indexes

- Major commodities

- More than 1,500 global stock CFDs

- 60 ETF and cryptocurrency CFDs

Where the range of offerings does fall short is the lack of spread betting instruments. XTB offers maximum leverage of up to 500:1 for non-U.K. accounts while U.K. accounts get up to 30:1 leverage.

To register XTB broker, click here XTB.Com

Customer Service

In this day and age, an online broker that does not place a high priority on addressing the needs of its customer in an efficient and satisfactory manner may be doomed to failure. XTB is well aware of this. Contact options cover all the bases, with email for clients and prospective clients, 24/5 local phone support, and a live chat facility. Additionally, clients are assigned an account manager to assist them with relevant account-related matters.

Phone support is responsive but the chat experience is a bit more erratic. It isn’t uncommon, for example, for live chat requests to be redirected to an email form instead. In the end, though, functional support is rendered. A phone number is easily available on xStation 5 and chat support can be launched from the trading platform, which is very convenient. Online customer support is available in several languages, which enhances XTB’s appeal to a broader client base. The broker also runs satellite offices to support licensed operations in several regions.

To register XTB broker, click here XTB.Com

Education

XTB’s educational offerings are on par with the industry standard. That said, it is apparent that the firm has identified this as a priority. The “courses” are divided into four categories—basic, intermediate, expert, and premium—though users can only access the first two through the website. “Premium” courses can be accessed free of charge on the xStation 5 platform, but one will have to sign up for an account (demo / live). The “expert” category has yet to be populated.

Each course includes both basic-level videos and articles. The material does not deviate from the industry norm of providing basic education on forex and CFD markets. Topics included: fundamental and technical analysis, risk management, and macroeconomics. New investors will find some helpful background information, but relying solely on XTB’s education to become proficient in the markets is unlikely. That said, the material covers all the major topics that a beginner should need to know.

Outside experts are also used for a few advanced topics and strategy updates, mainly in the free “premium” supplemental education section. Most of the content is well organized in a familiar lesson structure with videos and quizzes. XTB’s academy course design is ambitious in that it intends to cover material for people at different stages of the trading spectrum, but as of this review that is still a work in progress.

Outside experts are also used for a few advanced topics and strategy updates, mainly in the free “premium” supplemental education section. Most of the content is well organized in a familiar lesson structure with videos and quizzes. XTB’s academy course design is ambitious in that it intends to cover material for people at different stages of the trading spectrum, but as of this review that is still a work in progress.

To register XTB broker, click here XTB.Com

Portfolio Analysis

Placing a trade on xStation 5 is simple and intuitive. The order ticket is limited to initiating basic market and pending orders with provisions for “stop loss” and “take profit” orders. The trader also has the option of making the stop loss a trailing stop loss, should they so desire. XTB does not provide a trading journal nor do they provide tax accounting tools on the platform.

The client chooses the trade size and the order ticket populates with pertinent information, such as the contract value (in either EUR or GBP), margin required (GBP), spread cost, commission (if any), pip value, and swap costs.

Unlike some competitors’ platforms, xStation 5 does not have a built-in tool for analyzing trading activity. This omission dropped them into the lower-ranking tier for this category, as the ability to drill down into one’s trading activity beyond the basic metrics can be invaluable to all traders.

To register XTB broker, click here XTB.Com

Research Amenities

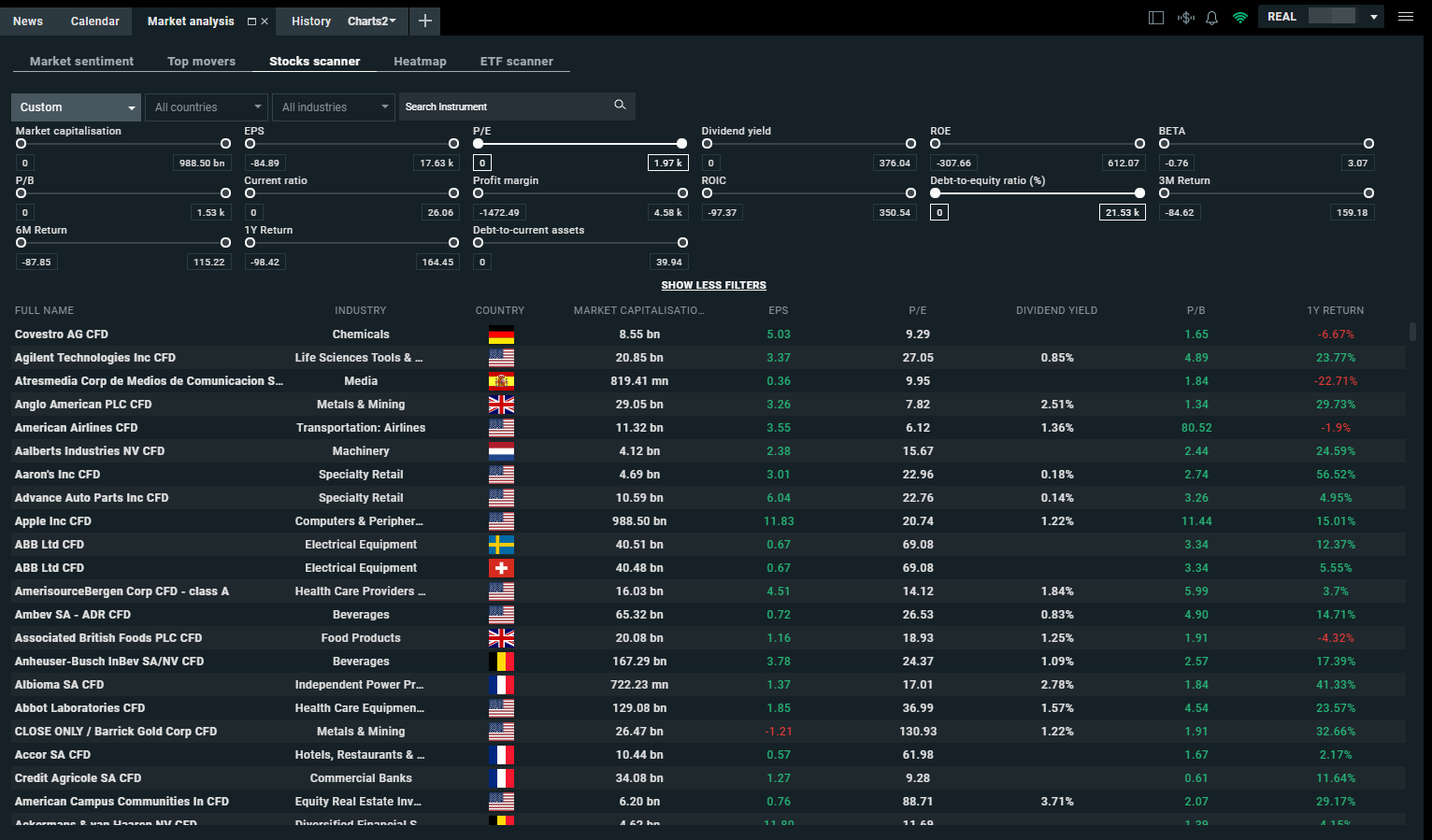

XTB’s research amenities are above industry standard. Aside from a standard economic calendar that is intuitive and filterable, XTB offers a functional news feed that can be filtered by “instrument,” “trading signal,” “economic reports” (fundamental), and “technical analysis.”

Additionally, there is a market analysis tab that is comprised of filterable “market sentiment,” “top movers,” “stock scanner,” and “heat map” sections. This is, by far, the most impressive aspect of XTB’s analytical tool offerings. Each section is well designed and includes some actionable, or at the very least interesting, information that can add value for traders.

To register XTB broker, click here XTB.Com

Security

- XTB U.K. is regulated by the Financial Conduct Authority under license number 522157.

- XTB Europe is regulated by CySEC under license number 169/12 as of 2018.

- XTB International is regulated by the Belize International Financial Services Commission under license number IFSC/60/413/TS/19.

- X-Trade Brokers DM SA is authorized by the Polish Securities and Exchange Commission under license number DDM-M-4021-57-1/2005 and supervised by the Polish Financial Supervision Authority (Komisja Nadzoru Finansowego).

- XTB Spain is regulated by the Comisión Nacional del Mercado de Valores under license number 40.

- XTB South Africa is awaiting license approval as of this review.

XTB offers negative balance protection, which is mandated under ESMA rules that went into effect in 2018, but no guaranteed stop loss orders (GSLO). XTB does not have two-factor authentication (2FA) but does offer bio-metric authentication for its mobile application, and requires that passwords include upper/lower case letters, numbers, and characters. While XTB does not have 2FA for its platform mobile offerings, it does offer 2FA for key client office processes such as personal or bank data changes.

To register XTB broker, click here XTB.Com

Verdict

XTB Online Trading (XTB) offers potential clients many of the tools that are needed to be successful in the online trading arena. What it does better than anyone else is offering clients the lowest forex spread cost in the industry. The costs (spread + commissions) for the other product offerings are more in line with the industry. xStation 5, while limited, is intuitive and functional, and certain features, such as the instrument scanner and heat map, heighten its appeal to any type of trader.

Being FCA regulated lends credibility while negative balance protection gives clients peace of mind. Customer service is slightly above average and the education catalog is adequate. MT4 offers “expert advisors,” back-testing, and auto-trading for the more technologically advanced trader. Overall, XTB Online Trading (XTB) is best suited for cost conscious clients wishing to engage in trading the retail foreign exchange markets.

To register XTB broker, click here XTB.Com

Methodology

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our reviews are the result of six months of evaluating all aspects of an online broker’s platform, including the user experience, the quality of trade executions, the products available on their platforms, costs and fees, security, the mobile experience and customer service. We established a rating scale based on our criteria, collecting over 3,000 data points that we weighed into our star scoring system.

In addition, every broker we surveyed was required to fill out a 320-point survey about all aspects of their platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices.

Our team of industry experts, led by Theresa W. Carey, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

To register XTB broker, click here XTB.Com

Summary

XTB is considered safe because it has a long track record, is listed on a stock exchange, and publishes its financial statements transparently.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB pros and cons

XTB charges low fees for forex trades. Deposit and withdrawal are fast and mostly free, and multiple options are available including credit/debit cards and electronic wallets. Account opening is also fast and user-friendly.

On the negative side, fees charged for stock CFD trading is high. XTB has a limited product portfolio, covering mostly CFDs and FX, although real stocks and ETFs are also available for some European clients. Additionally, XTB offers only basic fundamental data.

| Pros |

|---|

| • Low forex fees |

| • Free and fast deposit and withdrawal |

| • Easy and fast account opening |

| Cons |

|---|

| • High fees for stock CFDs |

| • Product portfolio limited mostly to CFDs and FX |

| • Limited fundamental data |

Fees

XTB has low forex fees and there is no withdrawal fee for most transfers. On the other hand, stock CFD fees are high, and XTB also charges an inactivity fee.

| Pros |

|---|

| • Low forex fees |

| • Free withdrawal for transfers above $100 |

| Cons |

|---|

| • High stock CFD fees |

To register XTB broker, click here XTB.Com

How we ranked fees

We ranked XTB’s fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let’s go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

In the sections below, you will find the most relevant fees of XTB for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared XTB’s fees with those of two similar brokers we selected, IG and eToro. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of XTB alternatives.

To have a clear overview of XTB, let’s start with the trading fees.

To register XTB broker, click here XTB.Com

XTB trading fees

XTB’s trading fees are low.

How you pay fees depends on your account type. In the Standard account, you pay only spreads, while in the Pro account you pay commissions in addition to market spreads, i.e. interbank spreads. We reviewed the Pro account.

We know it is hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments within each asset class:

- Stock index CFDs: SPX and EUSTX50

- Stock CFDs: Apple and Vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For the volume, we chose a $2,000 position for these stock index and stock CFDs and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index CFDs

- 5:1 for stock CFDs

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let’s see the verdict for XTB fees.

CFD fees

XTB has average stock index CFD fees, and high stock CFD fees.

| XTB | IG | eToro | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.4 | $1.2 | $1.5 |

| Europe 50 index CFD fee | $1.8 | $1.6 | $2.7 |

| Apple CFD fee | $17.3 | $31.3 | $6.7 |

| Vodafone CFD fee | $20.8 | $27.6 | – |

To register XTB broker, click here XTB.Com

XTB charges €3.5/£3/$4 per lot/contract per trade, plus the spread cost for stock index CFDs.

Stock and ETF CFD fees are charged as a volume-based fee, but a minimum fee applies.

| Market | Volume-based fee | Minimum fee |

|---|---|---|

| US | 0.08% | $8 |

| UK domestic, Germany, Portugal, Spain, France, Switzerland, Netherlands, Belgium, Denmark, Finland, Norway, Sweden | 0.08% | €8 |

| UK international | 0.08% | $10 |

| Czech Republic | 0.25% | CZK 300 |

| Italy | 0.08% | €8 + 0.07% of trade value |

In addition, XTB deducts a fee from dividend payments. For example, 30% is deducted from US stock dividends.

Forex fees

XTB’s forex fees are low.

| XTB | IG | eToro | |

|---|---|---|---|

| EURUSD benchmark fee | $8.3 | $17.3 | $8.8 |

| GBPUSD benchmark fee | $6.0 | $11.9 | $8.5 |

| AUDUSD benchmark fee | $6.5 | $14.7 | $8.2 |

| EURCHF benchmark fee | $8.9 | $8.8 | $12.6 |

| EURGBP benchmark fee | $8.4 | $16.6 | $12.3 |

To register XTB broker, click here XTB.Com

XTB charges €3.5/£3/$4 per lot per trade, plus the spread cost in the case of forex trading.

Real stock and ETF fees

XTB provides real stocks and ETFs only for EU customers onboarded under XTB’s Polish entity.

Stock and ETF fees are average in comparison with similar brokers; not as competitive as eToro’s zero fees, but a bit better than IG’s fees.

| XTB | IG | eToro | |

|---|---|---|---|

| US stock | $10.0 | $15.0 | $0.0 |

| UK stock | $12.0 | $10.4 | $0.0 |

| German stock | $12.0 | $12.0 | $0.0 |

Stock and ETF fees are charged as a volume-based fee, but a minimum fee applies.

| Market | Volume-based fee | Minimum fee |

|---|---|---|

| US | 0.12% | $10 |

| UK, Germany, Belgium, France, Italy, Netherlands, Portugal, Spain | 0.12% | €10 |

| Denmark, Finland, Norway, Sweden, Switzerland | 0.12% | €15 |

| Poland | 0.20% | PLN 5 |

XTB charges a 0.5% conversion fee whenever you trade an asset in a currency other than your account base currency.

To register XTB broker, click here XTB.Com

Non-trading fees

XTB has average non-trading fees. There is no account fee, no deposit fee for bank transfers or credit/debit card deposits, and no withdrawal fee for withdrawals above $100.

If you use electronic wallets, a 2% fee is charged. XTB charges a $20 fee for withdrawals below $100. In addition, there is a €10 monthly fee after one year of inactivity.

| XTB | IG | eToro | |

|---|---|---|---|

| Account fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Deposit fee | $0 | $0 | $0 |

| Withdrawal fee | $0 | $0 | $5 |

Account opening

| Pros | Cons |

|---|---|

| • Fast | None |

| • Fully digital | |

| • No minimum deposit |

XTB accepts customers from all over Europe and from most countries around the world.

To register XTB broker, click here XTB.Com

What is the minimum deposit at XTB?

XTB has no minimum deposit for individual accounts. On the other hand, corporate accounts require a relatively high £15,000 minimum deposit.

Account Types

There are two account types at XTB, each with different fee structures:

- Standard account: wider spreads, but no commission

- Pro account: tighter spreads, but there is a commission

We tested the Pro account. Some pages on XTB’s website contain information about Basic accounts, but this is a legacy account type you can’t open anymore.

If you open an account outside Europe, you can also open an Islamic account in addition to the above-mentioned account types. This account type is compliant with Islamic law and doesn’t charge swap fees.

A corporate account is also available.

How to open your account

XTB’s account opening process is fully digital, fast and straightforward. Filling out the forms and submitting all the documents takes around 30 minutes. Once you’re done, your account will be verified within a day.

The 5 steps of XTB account opening:

- Enter your email address and country of residency.

- Add some personal information, like your date of birth and address.

- Select the trading platform, account type and account base currency.

- Answer questions about your employment status, financial status and trading experience.

- Activate your account by verifying your identity and residency.

Some European clients can verify their identity via video, which is a great feature.

If video verification is not possible, you must upload a photo or scanned copy of your photo ID, passport or driver’s license. Utility bills and bank statements are accepted as proof of residency.

To register XTB broker, click here XTB.Com

Deposit and withdrawal

| Pros | Cons |

|---|---|

| • Credit/Debit card available | • Few minor account currencies accepted |

| • Free withdrawal | |

| • No deposit fee |

To register XTB broker, click here XTB.Com

Account base currencies

XTB’s account base currency selection includes USD, EUR and GBP. Besides these major currencies, HUF and PLN accounts are also available.

This selection of account base currencies is average compared to similar brokers.

| XTB | IG | eToro | |

|---|---|---|---|

| Number of base currencies | 5 | 6 | 1 |

Why does this matter? For two reasons. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don’t have to pay a conversion fee.

A convenient way to save on currency conversion fees is opening a multi-currency bank account at a digital bank. Digital banks offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Opening an account only takes a few minutes on your phone.

To register XTB broker, click here XTB.Com

Deposit fees and options

XTB charges no deposit fees. Electronic wallets such as Paypal or Skrill charge 2% of the deposited amount, which is quite high.

Besides bank transfer and credit/debit cards, many electronic wallets are also accepted for deposits.

- Paypal

- Paysafe (formerly Skrill)

- Neteller

- Paydoo

- PayU

- SafetyPay

- ECOMMPAY

- BlueCash

- Blik

- Sofort

Your country of residency determines which electronic wallets are available for you. For example, deposit via Sofort is available only for German customers.

| XTB | IG | eToro | |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Credit/Debit card | Yes | Yes | Yes |

| Electronic wallets | Yes | Yes | Yes |

A bank transfer can take several business days, while payment with credit/debit cards and electronic wallets is instant. You can only deposit money from sources that are in your name.

XTB review – Deposit and withdrawal – Deposit

XTB review – Deposit and withdrawal – Deposit

To register XTB broker, click here XTB.Com

XTB withdrawal fees and options

XTB charges no withdrawal fees if the amount is above $100. The only way to withdraw money is by bank transfer.

| XTB | IG | eToro | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Credit/Debit card | No | Yes | Yes |

| Electronic wallets | No | Yes | Yes |

| Withdrawal fee | $0 | $0 | $5 |

If you withdraw an amount below the threshold, XTB charges a high fee.

| Thresholds for small withdrawals | Withdrawal fee |

|---|---|

| < $100 | $20 |

| < €80 | €16 |

| < £60 | £12 |

| < HUF 12.000 | HUF 3.000 |

How long does it take to withdraw money from XTB? Bank transfer withdrawal took 1 business day. If you initiate the withdrawal before 1 p.m., it will arrive on the same day, otherwise it arrives on the next working day.

You can only withdraw money to accounts in your name.

How do you withdraw money from XTB?

- Log in to the trading platform.

- On the bottom right, click ‘Deposit and withdraw funds.’

- Enter your bank account details and the amount you wish to withdraw.

- Initiate the withdrawal.

Web trading platform

| Pros | Cons |

|---|---|

| • User-friendly | • No two-step (safer) login |

| • Clear fee report | |

| • Good search function |

| Trading platform | Score | Available |

|---|---|---|

| Web | 4.4stars | Yes |

| Mobile | 4.4stars | Yes |

| Desktop | 4.4stars | Yes |

You can choose between two trading platforms:

To register XTB broker, click here XTB.Com

- xStation 5, XTB’s own trading platform

- MetaTrader 4, a third-party tool

In this XTB review, we tested the xStation 5. This trading platform is available in many languages:

| Arabic | Bulgarian | Chinese | Czech | English |

| French | German | Hungarian | Italian | Japanese |

| Polish | Portuguese | Romanian | Russian | Slovenian |

| Spanish | Thai | Turkish | Vietnamese |

Look and feel

At first glance, xStation 5 might appear like a platform designed for professional users, but as you start to use it, you will find it well-designed and user-friendly, even if you are a beginner.

You can easily customize the web trading platform.

XTB review – Web trading platform

XTB review – Web trading platform

Login and security

Only one-step login is available. Two-step login would be more secure.

To register XTB broker, click here XTB.Com

Search functions

XTB’s search function is great. There are different ways you can search for an asset by clicking ‘Market Watch’:

- Type the name of the product in the search bar.

- Browse by various categories and product types. For example, if you want to trade a US stock CFD, just click on the stock type and select the US.

XTB review – Web trading platform – Search

XTB review – Web trading platform – Search

Placing orders

You can use the following order types:

- Market

- Limit

- Stop

- Trailing stop

If you are not familiar with the basic order types, read this overview.

There is also one order time limit you can use: Good ’til Time (GTT).

A useful feature of the platform is the trader calculator, which helps you calculate the margin, the commission and other important parameters for each trade.

To register XTB broker, click here XTB.Com

XTB review – Web trading platform – Order panel

XTB review – Web trading platform – Order panel

Alerts and notifications

We liked the ease of setting alerts and notifications. You can set up email, SMS and push notifications for important events such as margin calls, deposits and withdrawals, your closed/open positions, and other features.

Portfolio and fee reports

The platform has clear portfolio and fee reports, including the profit/loss of your positions. You can find them under the ‘History’ tab. Daily email reports are also available.

Mobile trading platform

| Pros | Cons |

|---|---|

| • User-friendly | • No two-step (safer) login |

| • Price alerts | |

| • Modern design |

Both xStation 5 (XTB’s own platform) and MetaTrader 4 have mobile platforms on iOS and Android. You can also use an Apple Watch. Similarly to the web trading platform, we tested xStation’s mobile application, using an Android device.

The mobile trading platform is available in the same languages as the web trading platform.

To register XTB broker, click here XTB.Com

Look and feel

XTB’s mobile trading platform is user-friendly and well-designed. You can easily find every important feature.

XTB review – Mobile trading platform

XTB review – Mobile trading platform

Login and security

The application provides only one-step login. Two-step login would be more secure.

At the same time, you can set fingerprint authentication on compatible devices. This is a great and convenient feature.

Search functions

xStation’s search function is great. You can type the name of the product in the search bar or just browse the different categories.

XTB review – Mobile trading platform – Search

XTB review – Mobile trading platform – Search

Placing orders

You can use the same order types as on the web trading platform:

- Market

- Limit

- Stop

- Trailing stop

There is also one order time limit you can use: Good ’til Time (GTT).

To register XTB broker, click here XTB.Com

XTB review – Mobile trading platform – Order panel

XTB review – Mobile trading platform – Order panel

Alerts and notifications

You can set many different types of alerts and notifications, including price alerts or notifications about important market news.

Desktop trading platform

| Pros | Cons |

|---|---|

| • User-friendly | • No two-step (safer) login |

| • Clear fee report | |

| • Good customizability (for charts, workspace) |

xStation 5’s desktop version is the same as its web equivalent version.

XTB review – Desktop trading platform

XTB review – Desktop trading platform

To register XTB broker, click here XTB.Com

Markets and products

XTB’s default product selection includes only CFDs, forex and crypto. Some European clients can also trade real stocks and ETFs. Popular asset classes like bonds, mutual funds, options and futures are not available.

XTB is primarily a CFD and forex broker. To learn more about CFDs, read our CFD trading tips.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XTB’s CFD selection is on the whole similar to eToro’s but not nearly as competitive as IG’s.

| XTB | IG | eToro | |

|---|---|---|---|

| Currency pairs (#) | 49 | 205 | 47 |

| Stock index CFDs (#) | 42 | 78 | 13 |

| Stock CFDs (#) | 1,800 | 10,500 | 2,000 |

| ETF CFDs (#) | 114 | 1,900 | 145 |

| Commodity CFDs (#) | 22 | 47 | 14 |

| Bond CFDs (#) | – | 13 | – |

| Cryptos (#) | 25 | 8 | 16 |

FCA bans the sale of crypto-derivatives to UK retail consumers from 6 January 2021.

You can’t change the default leverage level of the products. This is a drawback, as we believe this is an important factor you should be able to control.

Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Be careful with forex and CFD trading, as the preset leverage levels may be too high.

Real stocks and ETFs

Trading real stocks and ETFs is available for European clients, except in the UK, Cyprus, Hungary and Italy. The stock product selection is great, though the number of ETFs is low.

| XTB | IG | eToro | |

|---|---|---|---|

| Stock markets (#) | 17 | 8 | 17 |

| ETFs (#) | 220 | 2,000 | 145 |

Research

| Pros | Cons |

|---|---|

| • Good interactive chart | • Limited fundamental data |

| • Quality news flow | |

| • User-friendly |

XTB’s research tools come from two sources:

- The xStation 5 trading platform.

- The ‘Market Analysis’ section of the XTB website.

Research tools are available in many languages, such as English, Arabic or Chinese. However, when we set the platform’s language to English, we still got the news commentary in our own language.

To register XTB broker, click here XTB.Com

Trading ideas

XTB provides a few trading ideas, which can be found in the news flow. These trading ideas are usually short-term and based on technical tools.

However, these trading ideas are not well structured. For example, when you search for trading ideas about a specific asset, you get a lot of search results and it’s not easy to find the right one.

XTB review – Research – Recommendations

XTB review – Research – Recommendations

Fundamental data

You can only find limited fundamental data, such as the P/E ratio or the debt-to-equity ratio. However, you can’t access financial statements or operational metrics.

XTB review – Research – Fundamental data

XTB review – Research – Fundamental data

Charting

XTB has good charting tools. It is easy to edit and save charts. You can use 35 technical indicators, which is about average when compared to other brokers.

XTB review – Research – Charting

XTB review – Research – Charting

To register XTB broker, click here XTB.Com

News feed

News is provided by XTB’s own research team, which was voted ‘Best EMEA FX Forecaster’ by Bloomberg in Q2 and Q3 2018. The news flow is a mix of recommendations; data releases from the economic calendar; live “Traders Talks”; and brief messages about current market developments.

In the economic calendar, you can see upcoming events. When you select an event, you can read a short summary and check historical data.

XTB review – Research – Economic calendar

XTB review – Research – Economic calendar

Other research tools you will enjoy

The ‘Market sentiment’ feature shows the percentage of long and short positions among clients for each asset. Another tool, the ‘Heatmap’, visualizes winners and losers.

XTB review – Research – Market sentiment

XTB review – Research – Market sentiment

The ‘Stocks scanner’ uses 15 factors to filter stocks you may want to trade, including market capitalization, P/E, beta and debt-to-equity ratio.

To register XTB broker, click here XTB.Com

XTB review – Research – Stock screener

XTB review – Research – Stock screener

Another useful tool is the ‘ETF scanner’. This is very similar to the stock scanner, offering 10 filters such as cumulative return or the total value of assets. When we tested this tool, only three ETFs were visible and the filters we tried to change were not always working.

Customer service

| Pros | Cons |

|---|---|

| • Phone support | • No 24/7 support |

| • Live chat | |

| • Fast response time |

You can contact XTB via:

- Live chat

- Phone

You can reach customer service in many languages, including some minor ones like Hungarian or Romanian.

XTB’s live chat works well. We tested it in multiple languages in several countries. Responses were fast and we got useful answers.

We had a great experience when we tested XTB’s phone support. They answered the phone instantly and we got relevant answers.

To register XTB broker, click here XTB.Com

When we contacted XTB via email, asking for some help, we got a call back in a couple of hours. Customer Service answered our question sent via email, and could also answer all additional questions asked during the call.

Clients outside Europe can reach XTB’s customer support 24/7. For European clients, however, customer service is only available 24/5.

Education

| Pros | Cons |

|---|---|

| • Demo account | None |

| • Trading platform tutorial | |

| • Educational videos |

To register XTB broker, click here XTB.Com

XTB’s education materials are varied and of high quality, including:

- Demo account

- Platform tutorial videos

- General educational videos

- Webinars

- Quality ebooks and educational articles

We liked the structure of educational texts, as they are grouped based on the user’s trading experience as well as by subject. The texts are high quality, understandable and logically structured. At the end of each lesson, you can fill out a quiz. This is a great feature that is not usually offered by other brokers.

In April 2019, XTB held a unique educational event called Global Online Trading Masterclass. The event was live-streamed and participants could listen to classes by many trading experts.

To register XTB broker, click here XTB.Com

You can also watch educational and trading platform videos embedded into the texts on the website. XTB occasionally offers live webinars as well.

Safety

XTB is regulated by several financial authorities globally, including the top-tier FCA. It is listed on a stock exchange and discloses its financial statements regularly, but it has no banking license.

| Pros | Cons |

|---|---|

| • Listed on stock exchange | • Does not hold a banking license |

| • Negative balance protection | |

| • Some clients regulated by top-tier FCA |

XTB is based in London and in Warsaw. It is a global broker established in 2002, serving clients around the world, and has offices in more than 10 countries.

To register XTB broker, click here XTB.Com

Is XTB regulated?

It is regulated by several financial authorities:

- the UK’s Financial Conduct Authority (FCA)

- the Cyprus Securities and Exchange Commission (CySEC)

- the Polish Financial Supervision Authority (KNF)

- the National Securities Market Commission (CNMV) of Spain

- the International Financial Services Commission of Belize (IFSC).

Is XTB safe?

To be certain, we highly advise that you check two facts:

- how you are protected if something goes wrong

- what the background of the broker is

How you are protected

XTB operates via five different legal entities globally. This is important for you because the investor protection amount and the identity of the regulator differs from entity to entity.

Here’s a handy summary table for easy comparison:

| Client country | Investor protection amount | Regulator | Legal entity |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | XTB Limited (UK) |

| Italy, Cyprus, Hungary | €20,000 | Cyprus Securities and Exchange Commission (‘CySEC’) | XTB Limited (CY) |

| Spain | €20,000 | National Securities Market Commission (CNMV) | XTB Sucursal |

| Other European clients | €20,100* | Polish Financial Supervision Authority (KNF) | X-Trade Brokers Dom Maklerski SA |

| Clients outside Europe (except China) | No protection | International Financial Services Commission of Belize (IFSC) | XTB International Limited |

*The investor protection amount is 100% up to €3,000, 90% up to €22,000, for total max. compensation of €20,100

To register XTB broker, click here XTB.Com

XTB provides negative balance protection for forex spot and CFD trading, but only for retail clients from the European Union. Professional and non-EU clients are not covered by any negative balance protection.

Background

XTB was established in 2002. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises.

XTB is listed on the Warsaw Stock Exchange, which is a big plus for safety as XTB releases its financial statements regularly and transparently.

Being listed on a stock exchange, being regulated by financial authorities and providing financial statements are all great signs for XTB’s safety.

Bottom line

XTB is a great CFD and forex broker. It is regulated by several financial authorities globally, including the UK’s FCA. The company is listed on the Warsaw Stock Exchange.

On the plus side, its forex fees are low, and the deposit and withdrawal process is fast and mostly free. We also liked the seamless and hassle-free account opening process.

XTB has some drawbacks, though. Stock CFD fees are high. The product range is mainly limited to FX and CFDs, although real stock and ETF trading are available in some European countries. Fundamental data offered by XTB covers only a few basics such as P/E.

We recommend XTB for clients who prefer forex or CFD trading, and also want to enjoy great deposit and withdrawal options along with fast account opening. Feel free to test it using a demo account.