Introduction of NordFX broker

Although NordFX has been developing in the world market for a long time in the Forex market.

NordFX was established in 2008, after 11 years of operation, NordFX now has more than 1.2 million customers from more than 100 countries worldwide.

To register NordFX broker, click here

NordFX is a firm owned by NordFX CY (NFX CAPITAL VU INC), based in Port Vila, Vanuatu. There are many offices around the globe, focusing on thriving in markets such as Russia, China, Thailand, India and Vietnam.

The operating licenses and insurance policies for NordFX’s traders

The operating licenses and certificates

In terms of regulation, NordFX is regulated by the VFSC Financial Services Commission of Vanuatu with code 15008 and the Indian Securities and Exchange Commission (SEBI).

NordFX is also licensed by the Cyprus Securities and Exchange Commission (CySEC). As a member of EU, , CySEC’s financial regulations and operations comply with European MiFID financial laws.

To register NordFX broker, click here

Types of NordFX’s trading accounts

NordFX is better evaluated than other because it allows traders to open accounts quickly via social networking channels such as Facebook and Twitter.

NordFX offers 4 different types of trading accounts (excluding Demo accounts), including:

Xem thêm:

- Top 10 Sàn Forex, Trading Vàng, Bitcoin 2021. Đánh giá 10 sàn giao dịch Forex, Vàng, Bitcoin uy tín nhất

- Mở tài khoản chứng khoán trực tuyến, Top 10 Sàn giao dịch chứng khoán Việt Nam uy tín nhất, Top 1 Công ty chứng khoán phí thấp nhất

- Fix account

- Pro account

- Zero account

- Crypto account

Fix account

- Minimum initial deposit: 10$

- Instruments: 28 forex pairs + 14 cryptocurrency pairs + precious metals + 6 crypto indices

- Commission: No

- Quote price: 4 decimal places

- Leverage up to: 1:1000

- Spread: from 2 pips

To register NordFX broker, click here

Pro account

- Minimum initial deposit: 250$

- Instruments: 33 currency pairs + 14 cryptocurrency pairs + precious metals + 6 crypto indices

- Commission: No

- Quote price: 5 decimal places

- Leverage up to: 1:1000

- Spread: from 0.9 pips

To register NordFX broker, click here

Zero account

In my opinion, it is also the most used trading account on NordFX and it is ideal for scalping traders with the lowest possible spread of only 0.0 pips.

- Minimum initial deposit: 500$

- Instruments: 33 currency pairs + 14 cryptocurrency pairs + precious metals + 6 crypto indices

- Commission: 3.5$/lot

- Quote price: 5 decimal places

- Leverage up to: 1:1000

- Spread: from 0.0 pips

To register NordFX broker, click here

Crypto account

NordFX offers E-Money accounts with a minimum deposit of $10. Depending on the type of account you choose, you can deposit in USD, B.T.C or E.T.H, ….

- Minimum initial deposit: 500$

- Instruments: 16 cryptocurrency pairs + 4 crypto indices

- Taker charge: 0.09%

- Maker charge: -0.02%

- Spread: from 1 pip

- Swap: 14% per year

To register NordFX broker, click here

Currently, it can be said that NordFX is one of the well-rated cryptocurrency exchanges in the market. You can trade 24/7/365 without waiting for open sessions such as Forex.

In addition, starting in April 2019, NordFX customers can use one of the most popular authorised management methods available today, called PAMM.

NordFX’s PAMM service offers a range of trading tools available for Pro and Zero accounts, including 33 currency pairs, metals, 15 cryptocurrency pairs, 4 cryptocurrency indices and CFD contracts for stock and oil indices worldwide.

To register NordFX broker, click here

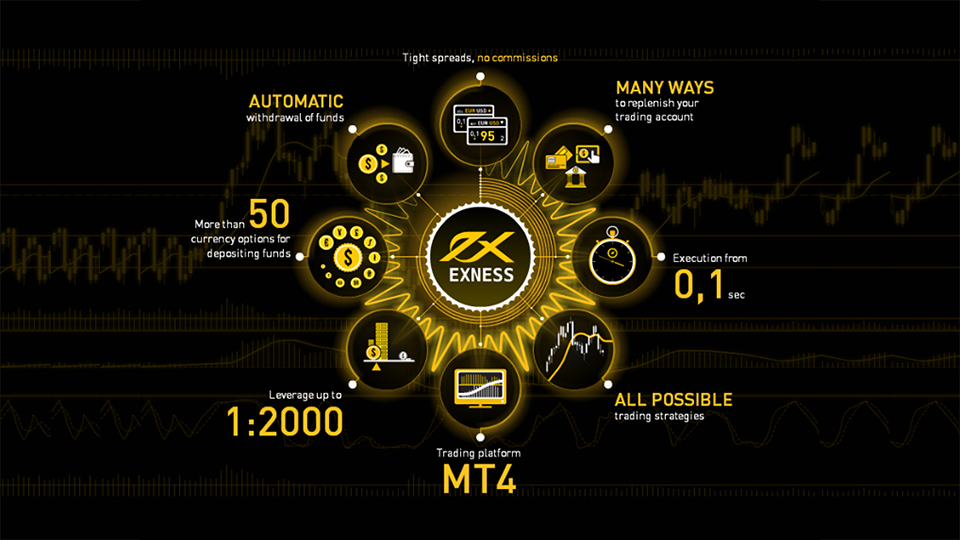

NordFX trading platform

NordFX uses MetaTrader 4, MetaTrader 5 and MetaTrader 4 MultiTerminal as a exclusive program for investors, professional traders and fund managers managing multiple accounts at the same time with user-friendly interface and full of features.

Instruments and services on NordFX

Instruments on NordFX broker

There are totally 33 currency pairs, 14 cryptocurrency pairs, 4 cryptocurrency indices, gold and silver (depending on each type of account)

To register NordFX broker, click here

Investment management services

There is a special feature of NordFX different from other online brokers, in addition to providing trading instruments for traders, they also provide management investment services.

By investing in funds managed by NordFX, traders have the right to choose the amount as well as the duration of the investment. They can deposit and withdraw money whenever they want (with specific withdrawal fees by deadline).

Specifically, you will have 3 options, including:

- Pro Industry Fund

- Pro Tech Fund

- Pro Expert Fund

To register NordFX broker, click here

Customer support service of NordFX broker

NordFX’s website supports up to 14 different languages including English, Russian, Chinese, Indonesian, Spanish, Portuguese, Arabic, Hindu, Malay, Thai, Vietnamese.

You can access the website to ask staff for support via email, phone or livechat. Should you want direct support, there are 5 local phone numbers in China, India, Russian Federation, Sri Lanka and Thailand.

Moreover you can also contact NordFX through social media channels such as Facebook and Twitter …

To register NordFX broker, click here

Deposit and withdrawal methods of NordFX broker

The deposit and withdrawal of NordFX broker are considered as the most highly-rated factor in worldwide.

NordFX offers a variety of payment methods, suitable for all investors in different markets.

Deposit

NordFX now supports up to 15 payment methods allowing you to freely choose which option suits you best, such as WebMoney, Neteller, Skrill or Perfect Money, …

You can deposit via Bank Transfer in USD, EUR or RUB, also use Visa or Mastercard to make instant deposit with no charge.

NordFX does not collect any deposits from customers, you only pay your payment charges as prescribed.

Withdrawal

Regarding withdrawals, as above, I recommend Internet Banking